In August, these original factories announced price increases, and the market of many kinds of materials heated up!

Date:2021-08-20 14:16:00 Views:2973

The electronics industry has entered the peak season, and the epidemic has raided many important industrial areas,IC market shortage and price riseContinuation.In August, several IC original factories started to raise prices. Although the number was lower than that in June and July, the key areas did not fall, including m, which is currently the most in demandCU、Passive element, even mobile phonesSoC prices have risen。

Shengqun, Xintang and other officials announced price increases,MCU market in short supply

In August, three manufacturers in MCU market deserve the most attention. First, shengqun confirmed that the price has increased by 10% - 15% since August, but this is not the first price increase of the factory this year. As early as April, shengqun had raised the price of the whole line of products by 15%, and the price rise in August had long been announced by shengqun, which was not unexpected at the moment of tight market conditions.

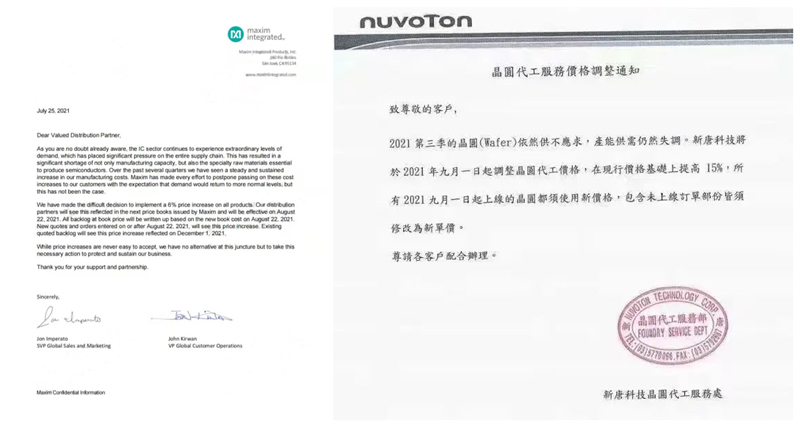

Among the price increases that took effect in August, Meixin also needs to pay attention. The factory announced that the price of all products will increase by 6% from August 22. Meixin focuses on power management IC and sensor, and also has MCU product line. At this time, the price rise will obviously contribute to the market.

In August, Xintang also issued a price adjustment letter. The difference is that Xintang's price increase is aimed at its wafer foundry services, not finished materials. It is understood that Xintang's main business includes both finished IC and wafer foundry services. The wafer foundry services are used for MCU and power semiconductor. The price increase of Xintang is a 15% increase in the price of wafer foundry services, which will take effect from September 1.

[price adjustment letter from Meixin and Xintang Source: Internet]

In August, the prices of many original factories increased, which confirmed that the MCU market did not step on the brake, at least covering the whole year of this year. Looking back on this year's supply chain events, the cold wave in North America in the first half of the year damaged the production capacity of major factories such as Samsung and Infineon, and the fire stopped the important factory of Renesas MCU for several months; The outbreak in Malaysia in the second half of the year affected the local IC manufacturing and sealing and testing capacity. All kinds of accidents caused huge lossesCUSupply gap, the impact has continued.

According to investment bankAccording to Susquehanna's data, the shortage of MCU for various purposes such as automobile, industrial control and consumer electronics intensified in July, and the delivery time was extended to 26.5 weeks, while the average delivery time of various chips in the same period was 20.2 weeks, which shows the severe shortage of MCU.

According to more market information and media reports, Infineon, NXPThe delivery time of MCU of microchip, Renesas and other large manufacturers is generally more than 26 weeks, and the longest is even 52 weeks. What is more scarce than these manufacturers is the MCU of St. At present, the 8-bit and 32-bit MCU of multiple series of St brand no longer provide specific delivery date, but should be delivered according to the original factory distribution. In addition, like st, some of NXP's vehicle materials are in short supply so that the delivery date cannot be given.

At present,The price rise of MCU has spilled over from large international manufacturers to manufacturers in Taiwan and Mainland China. The price rise of shangshengqun and Xintang is proof. In the follow-up, even if the market peak season comes, the major terminal manufacturers are trapped in shortage and rising prices, and their production capacity and profit performance will be restricted. As for when the market will turn over, we can only wait for the expansion of production by each factory to fundamentally reverse the situation of supply and demand.

Passive componentsConnectorMobile phone chipThere are also price increases

In terms of passive components, it is reported that8month9. American series resistance factoryVishayAnnounce a price rise10%-20%。 Previously, the Philippines had just implemented control in the capital Manila, which would affect the output of local passive components and increase the difficulty of downstream goods preparation.

In addition to Malaysia, the two major passive component producing areas in Southeast Asia have been controlled, which widely affects all kinds of resistors, capacitors and capacitorsMLCCThe production and transportation of are not conducive to the stability of the market. Delta virus is rampant, Southeast Asia and the United States do not have the conditions for reopening in the short term, and the delivery date and price of passive components will continue to rise.

8月alsoA connectorAnd a familySPrice increase of OC manufacturers。Connector aspect, the report points outFamous big factoryMolex announced a 7% price increase across the board, 10月Effective 1. In addition to the price increase, the delivery date of Molex products is generally 2More than 4 weeks,And it may be postponed at any time。

On the whole,The connector market is relatively flatAnd,The delivery date is generally8-18周, price increases are also more restrained, probably becauseThe phenomenon of "long and short materials" is prominent, and manufacturing enterprises areMCU, etcIWhen the C element cannot be in place,The demand for connectors and other materials decreased,As a result, the market is relatively flat。

Finally, let's mention the rise in the price of mobile phones。End of July,Ziguang zhanrui sent a letter to comprehensively raise the price of intelligent machine product line25%,Effective August 1. Ziguang zhanrui intelligent machine products include soC、AI operation chip, etc,use12nm、28nm process OEM, the price rise of these chips reflects the current situation of higher upstream OEM costs and capacity shortage.

【MOLEX, zhanrui price adjustment letter [source: Internet]

summary:Shortage and price rise continue, the peak season is also a test

Listed aboveThe price rise trend of the original factory in August involves many fields, including IThe main reason for the increase in the price of component C is the increase in the price of OEM、demand exceeds supplyAnd the epidemic situation in the origin, the price rise of passive components is more due to the production reduction caused by the epidemic situation in the origin. Due to the different delivery dates of various components, the degree of shortage is also different, resulting in the phenomenon of short and long materials. In addition, repeated orders, hoarding and speculation also cause demand distortion, and the degree of shortage is overestimated, but it will be more difficult for downstream manufacturers to obtain materials.

For the electronic manufacturing industry, the peak season is coming, but it also becomes a test. The tight market of components will increase the cost of materials prepared by the manufacturer, and the ultra long delivery period will also inhibit its delivery capacity, which will eventually affect the profit. It is the primary problem of the electronic industry chain to come up with countermeasures to overcome the most difficult period of the market. To completely reverse the market, we still have to wait until the production expansion of each factory is in place to ensure the smooth supply of goods.

Weixin Service

Weixin Service

DouYin

DouYin

KuaiShou

KuaiShou