What has the IC supply chain become? An original price adjustment letter was revealed

Date:2021-05-07 15:36:00 Views:6049

In the second quarter, chip shortage and price rise continued. stayIn April, many chip manufacturers at home and abroad successively sent letters to raise prices and suspend orders. At the same time, wafer foundry also began a new round of price increases. Various signs show that the shortage of chips and the rise in prices are bound to reach a new height. The market in the "post epidemic era" is destined to be extraordinary.

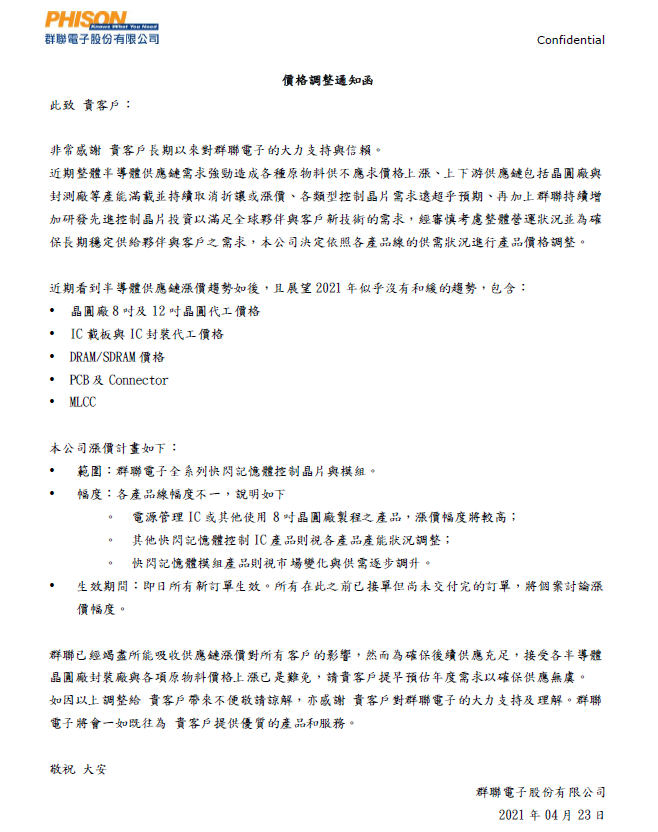

Recently, the Taiwan chip factory Group Association issued a price adjustment notice letter, which is not prominent under the situation that the price increase letters have been snowing in the past six months. However, it is worth noting that this letter from qunlian contains a large amount of information, which not only points out the category, range and effective time of the price increase, but also summarizes the situation in the upper reaches of some industrial chains, which can be seenThe "heroic picture" of the general rise of IC industry chain.

First of all, let's look at the categories targeted by the price increase of group alliance, including power managementIC and other chips manufactured with 8-inch wafers have a high price rise, and NAND flach master chips and modules are adjusted according to the production capacity of each product and market supply and demand. As for the reasons, qunlian mentioned many upstream factors of the industrial chain, covering all important aspects at present.

Wafer foundry

8 "and 12"Wafer foundryThe price rise is ranked first by the group, and this is indeedIC supply chain is the part with the most price increases. Since the second half of last year, the shortage of foundry capacity and price increase began with the 8-inch mature process, affecting the drive IC, power management IC, MCU, etc., and then began to spread to 12 inches. Today, both 8 inches and 12 inches have accumulated a great increase.

For the specific wafer foundry, the current report disclosed that the prices of Jidian, liandian, SMIC and other factories have increased this year. Among them, TSMC's price increase is mainly in the form of canceling discounts; a joint circular telegram8-inch OEM increased by nearly 40% compared with the end of last year, and 12 inch OEM increased by more than 26%; SMIC also rose 15% - 30% in March and April.

From the above data, it can be seen that the price of wafer foundry has generally increased by 30% to 40%, which will certainly significantly increase the cost of downstream chip factories. cast asideRegardless of fabless manufacturers, even if the chip factory has its own production line, it will widely produce a large number of products with the help of OEM. If the cost rises beyond a certain limit, it will be shared by the client.

In order to cope with the continuous flow of orders from chip factories, the wafer foundry is planning to expand production, including TSMC and liandian28nm production expansion plan, but what the market lacks most is 8-inch mature process, even micron process. This part of production expansion is limited by the limited equipment circulating in the market, so it is difficult to expand production. Therefore, the lack of capacity and price increase of wafer foundry will be maintained or even strengthened in the future.

Chip sealing test

Listed in the following group associationThe price rise of IC carrier and IC packaging is also a "disaster area". Previous reports pointed out that the semiconductor packaging and testing capacity is fully tight, especially in wire packaging, and the order to shipment ratio is close to 1.5. The leading Sunmoon and other manufacturers have increased the price of wire packaging by 5% - 10% in the first quarter, and will increase the price by 10% quarter by quarter in the second and third quarters.

As for the reasons for the price increase of closed beta, on the one hand, there is a shortage of equipment and there is no time to expand production. At present, the delivery time of equipment is as long asFor more than 6-9 months, the sealing and testing plant cannot expand production in a short time. On the other hand, the price rise of IC carrier plates and other materials is also putting pressure on the sealing and testing industry. Part of the reason for the price rise of Riyue in the first quarter is the rise in the cost of IC carrier plates and other materials since the second half of last year.

DRAM, PCB, connector, MLCC

These materials should be module products for group connection. Among them,DRAM's rise was only launched this year, which is much later than the overall price rise of IC. At the beginning of the year, several DRAM original factories said that they would not increase capital expenditure this year, which is equivalent to reducing production in a disguised form. Under the joint action of the original factory and the market, DRAM generally increased by 30% - 50% in the first quarter of this year, and even more than 80% in extreme cases.

as forThe price rise of PCB, connector and other materials is directly related to the price rise of raw materials such as upstream copper clad laminate, epoxy resin and plastic. Various commodities began to rise when the global epidemic subsided slightly in April last year. Up to now, they have accumulated a lot of gains, which is enough to drive the prices of downstream industries.

last,The price increase of MLCC basically starts after the Spring Festival, and before the Spring Festival, the delivery period of the original factory is mainly extended. In the first quarter, the prices of major MLCC original factories such as Guoju, huaxinke and Samsung motor have increased by more than 20%. The latest news in the MLCC market is that the delivery period of the original solar induced electricity in the Japanese system has been extended. In addition, the prices of other passive components, such as tantalum capacitors, aluminum capacitors and resistors, also began to rise this year, forming a general rise pattern of passive components together with MLCC.

The price adjustment letter from qunlian can be said to comprehensively summarize the upstream factors, which can be seen by people inside and outside the industryThe IC industry chain is in short supply. According to the prediction of senior executives of major chip enterprises, this wave of shortage and price rise will last at least until the end of this year. In the coming days, I'm afraid there will be more original factories sending letters to adjust prices or announcing that they will stop receiving orders this year. For the majority of people in the industry, there is still a long way to go to survive this wave of "lack of core" tide.

Weixin Service

Weixin Service

DouYin

DouYin

KuaiShou

KuaiShou