Mature process chips are in short supply, and manufacturers see the right time to expand production

Date:2021-07-22 10:24:00 Views:3230

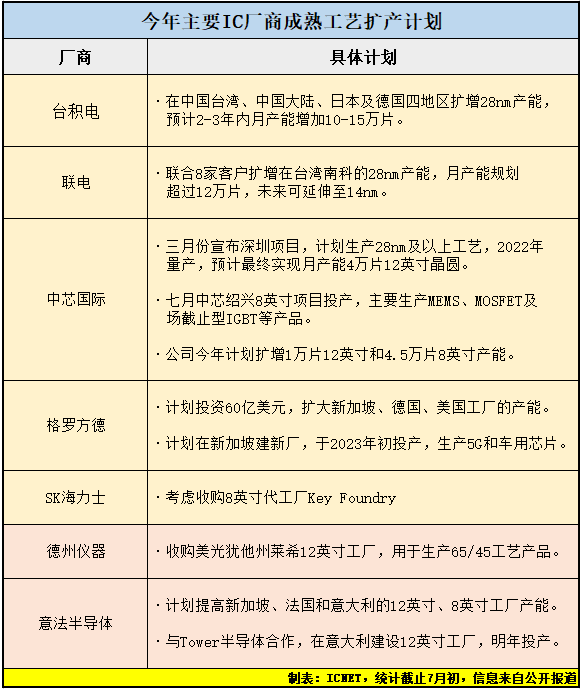

Since the epidemic, the tide of core shortage has intensified, and the prices of out of stock have been increasing. Major chip foundry and IDM manufacturers have identified the opportunity to expand production. All factories aim at the most scarce mature process chips, including vehicle chips, MCU and various drive ICs.

In each node of the mature process, 28nm process can well balance the factors such as performance, cost and depreciation. It is an important option for the expansion of wafer foundry. At the same time, TI's acquisition and expansion of 12 inch capacity to manufacture analog chips is also an important industry phenomenon, from which we can see the future trend of Analog IC industry.

From the summary of the above information, it can be seen that the expansion of each OEM is generally concentrated in the 28nm node, and other more advanced 14nm nodes are aimed at the most lack of automotive chips, sensors, touch IC and other chips. The specific mode of production expansion is different according to their own strength and current situation.

TSMC, as the world's No. 1 wafer foundry, has the largest capacity expansion this time. Among the four plants involved, there is no obstacle to the expansion of production in Taiwan. In the early stage, there was a rumor in the mainland Nanjing plant that it might not be realized due to the pressure of U.S. policy. However, TSMC clarified that not only the Nanjing plant still expanded its production by 28nm as planned, but also the 16 / 12NM production line will be arranged here in the future, which is the final answer.

As for TSMC's new plant in Japan, the report points out that the chip factory close to Sony is used for CIS, automotive chips and other products. The situation disclosed by the German factory is less, but considering that Germany is a powerful automobile industry, its products must be inseparable from driving chips. After this round of chip shortage, Europe intends to expand chip production capacity, so it will also vigorously promote cooperation with TSMC, but whether it can finally attract TSMC's implementation actions needs continuous attention.

In terms of liandian, this year's production expansion will be carried out simultaneously with 8 customers, including well-known IC manufacturers such as Samsung, Qualcomm and Ruiyu. This way of production expansion allows customers to book the urgently needed order share first. For liandian, it can reduce the cost and avoid the risk of vacant production lines in the future. Specific applications are aimed at vehicle chips, touch IC and sensors.

As the first generation factory in China, SMIC is also expanding its production. In particular, the plan to expand 10000 12 inch wafers and 45000 8-inch wafers this year is not small, which can alleviate the tension of chip supply, especially for the domestic market. It is reported that SMIC and another local foundry Huahong semiconductor will focus on orders from mainland customers in the future, and the order priority in other regions will decline.

Grofangde has been in a poor position in the industry in recent years, but it has also taken action in this wave of core shortage, including increasing capital expenditure and even expanding new plants. However, the latest news points out that grofangde may be acquired by Intel. It remains to be seen whether this will affect the plant's production expansion plan. Sk Hynix has always had a low sense of presence in the OEM industry. The acquisition of an 8-inch OEM can directly and quickly enrich the OEM strength. Obviously, it doesn't want to miss this opportunity.

The following twoAmong IDM manufacturers, Texas Instruments acquired the original production of Meguiar at a relatively low priceThe OEM of 3D x-point is used to produce mature process chips. STMicroelectronics also increased production capacity and met market demand by increasing capital expenditure and cooperating with foreign factories.

Above mainAmong IC manufacturers, OEM and IDM manufacturers expand their production with 28nm as the main axis, and some also retain the potential to upgrade the next generation process. As for why we aim at 28nm, first of all, as a more advanced node in the mature process, it is used to produce MCU, sensor, power management IC and surfacePlate driveIC and other chips can give consideration to both performance and energy efficiency ratio, and meet the increasingly stringent requirements of downstream terminal manufacturers. For the foundry, the 28nm production line is relatively advanced, which can maintain a longer year after investment, and can significantly save depreciation costs.

Of course, there are more analog chips based on older processes. This time, Texas Instruments expanded its production through acquisition, not to build a 28nm production line, but to introduce an older 65 / 45nm process for the production of embedded chips and analog chips. The purpose of this is to migrate the existing products to the 12 inch platform, which can reduce costs, increase supply, and then improve the profit level of the original factory.

In recent years, analog chips are turning to 12 inch wafers, and Texas Instruments is leading other manufacturers. With this acquisition, Texas Instruments already has four 12 inch wafer plants. Past financial data show that the 12 inch production line plays a practical role in improving ti's profit margin. This acquisition will consolidate its advantages and help Ti continue to take the lead.

Finally, it is concluded that the shortage and price increase of many important chips such as MCU directly promote the production expansion and mature process of each factory. With the gradual opening of new production capacity, this round of core shortage tide will be alleviated and finally subsided. Of course, this process should be carried out on an annual basis. The current shortage and price rise are still at the peak. In particular, Malaysia, Vietnam and other important industrial areas have been plagued by the epidemic recently, which poses a severe test to the short-term market.

Weixin Service

Weixin Service

DouYin

DouYin

KuaiShou

KuaiShou